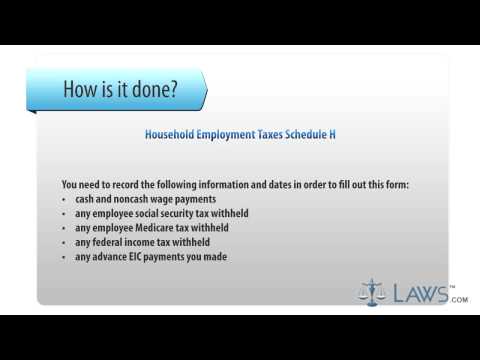

Laws.com legal forms guide, Household Employment Taxes Schedule H. You need to fill out this form if you answer yes to any of the questions on lines A, B, or C. A detailed list of instructions is provided by the IRS at the following link. Step 1: The following dates are important. January 31st, 2012 - give the employee a Form W-2. February 29th, 2012 - send copy A of Form W-2 along with Form W-3 to the Social Security Administration. April 17th, 2012 - file Schedule H and pay the household employment taxes with the 2011 tax return. Step 2: You need to record the following information and dates in order to fill out this form. Cash and non-cash wage payments. Any employee Social Security tax withheld and the employee Medicare tax withheld. Any federal income tax withheld. Any advanced AI C payments you made. Step 3: If you paid a household employee $1700 or more cash wages during 2011, you need to report and pay Social Security and Medicare taxes on all wages. See page H4 of the instructions for specific instructions on lines one through seven. Step 4: The FUTA tax provides payments for unemployment compensation for workers who have lost their job. The FUTA tax is 6.2% before July 1st and 6.0% after June 30th. However, you may be able to take credit up to 5.4% against the FUTA tax if you pay all required contributions by April 17, 2012. Contributions do not include the following - any payments deducted from your employees' pay, penalties, interest, or special administrative taxes that are not included in the contributions rate by your state, voluntary contributions you paid in order to get a lower experienced rate. See pages H4 and H5 of the instructions for specific details on lines...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 990 Schedule H 2024-2025