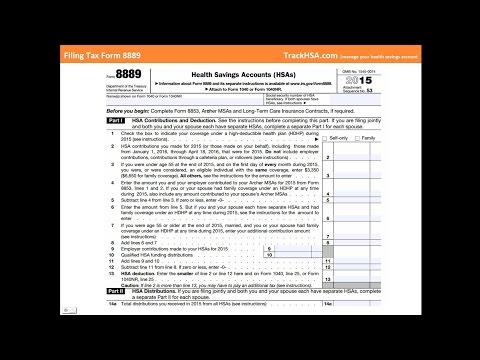

Hey everybody, this is Evan from Trac HSA. Today, we're going to talk about how to file Form 8889, the government-required form for your health savings account. This session is brought to you by Trac HSA. It's a website I created to help you manage your health savings account. All those purchases, receipts, reimbursements, all organized online safely for free. So, all your data is there next year when you go to file. This way, you'll have everything you need right there at Trac HSA. So, what I want to do today is talk about Form 8889 and walk you through the steps to actually file this thing because it's kind of a beast. The government has not made it easy for us. We're going to review all three parts of this form and all the "es" in those parts with step-by-step instructions so we can understand what's going on. And even better, I'm going to show you examples of the completed forms so you can kind of see how everything relates to each other. Now, there are three main parts of this form, and the goal of it is to kind of summarize all the activity going on in your HSA for the year. So, the first part is talking about contributions - what came in. Maybe you contributed, maybe your employer contributed. The second part talks about distributions that came out of your HSA. The government wants to see this number to verify proper spending. Finally, there's a third section to determine if you owe any extra taxes or penalties because we didn't conform to the law. We're going to show you how to avoid this and make sure that your return is filed properly. Let's first talk about who needs to file the form though, before we get into...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 990 Schedule H Worksheets