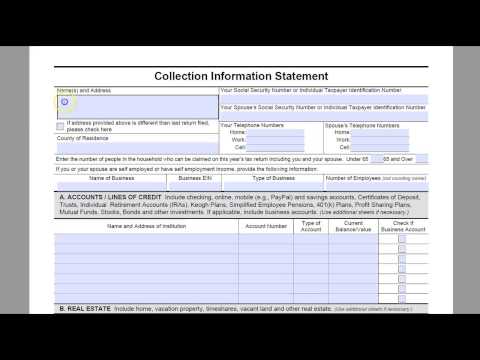

Hello, Amanda Kendall. Today, I am going to walk you through how to fill out Form 433-F. This form is used for setting up a payment plan with the IRS if you have a balance under $50,000 and cannot pay it in full within six years. To qualify for a streamlined installment agreement, you must meet certain criteria. If you owe over $50,000 but are not self-employed or assigned to the collections department, this form is for you. If you are with a revenue officer, you will need to fill out Form 433-A, which is explained in another video. For this example, we will be filling out the form for James and Amy Johnson. If their address is the same as the last filed return, you do not need to check anything. In this case, the address is the same, so we will proceed to fill in their county of residence as Denver County. Next, you will enter the social security number of the person listed first on the form, which should match the person listed first on the tax return. Then, list a phone number for at least one of the individuals, if not both. The next question asks you to enter the number of people in the household who can be claimed on this year's tax return, including you and your spouse. Both James and Amy are under 65 years old and have a twelve-year-old son, so we will indicate that they have three people under 65 to claim. The form also asks if you or your spouse are self-employed or have self-employment income. For this example, we will include that information, but note that Form 433-A is more suitable for self-employed individuals. Moving on to Section A, which includes accounts, lines of credits, and various financial assets....

Award-winning PDF software

Video instructions and help with filling out and completing Form 990 Schedule H Instructions 2024-2025