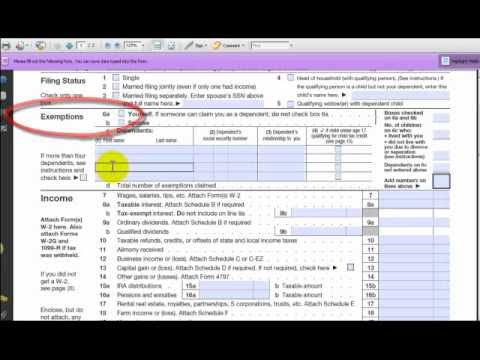

Hello, this is Sarah. This is another episode of how to do your own taxes. Thanks for joining us today. We're going to talk about the main form every individual has to file when they do their taxes every year, and that form is called the 1040 form. 1040 form can be found on the irs.gov website. Other places you can find it are by calling the IRS 800 number or going to the local post office. They usually have that form and a few other forms, unless they run out. You can also go to the local tax office. If you have a computer, the easiest thing to do is to look at an IRS.gov where you can find all the tax forms that the IRS wants you to fill out. You can put the form number and the form description in the search bar, and you will find it. Now, when you do your taxes and it's all done, you can come back to the same page and click on "your refund" to check the status. You can also find information about your refund by clicking on the link provided. Additionally, you can find information about free filing by clicking on the respective link. However, keep in mind that free filing is only available if you make under fifty-eight thousand dollars. If you have extra forms, you may be charged for them, so it's not completely free. Now, let's go to the form. The first thing you do is fill in your name, address, and social security number. It's recommended to print out the form so you can make notes and do a rough draft before filling it in officially. Filing status can be either single, married, or filing jointly. Next, you fill in exemptions which include yourself, your spouse, and...

Award-winning PDF software

Video instructions and help with filling out and completing What Is Form 990 Schedule H