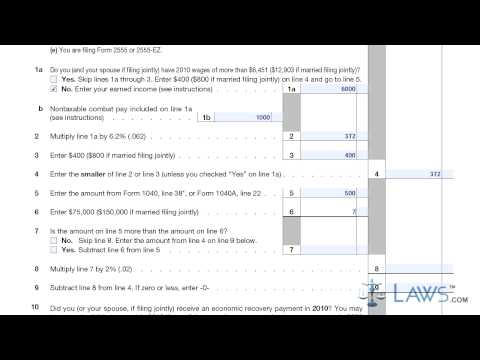

P>Law.com legal forms guide: Making Work Pay Credit Schedule M Step 1: This form is not used for the Government Retiree Credit anymore, because the credit was only available for 2009. The credit applies if you have earned income from work, and the credit can be as high as four hundred dollars or eight hundred dollars if filing jointly. The credit cannot be filed if the amount entered on line five of Schedule M is ninety-five thousand dollars or more, or one hundred ninety thousand dollars or more if filing jointly. You are a non-resident alien, or you are claimed as a dependent on someone else's tax return. Step 2: In order to take the credit, you need to provide your Social Security number on the return. Do not substitute your IRS issued identification number. Step 3: To fill in line one, you should regard line seven of 1040A or 1040EZ. Refer to page M two of the following instructions. Step 4: On line 1B, enter total non-taxable combat pay you or your spouse received in 2010. This amount is shown in 12 of Form W-2 with code Q. Step 5: If you are filing Form 2555, 2555EZ, or 4563, or excluding income from Puerto Rico, add the following amounts onto the figure on Form 1040, line 38: any exclusion of income from Puerto Rico, plus any amounts from the following: Form 2555 lines 45 and 50, Form 2555EZ line 18, and Form 4563 line 15. Step 6: Line 10: An Economic Recovery Payment is a $250 payment sent to you by the US Treasury if you receive Social Security benefits or any other benefits listed on line 10 during November or December of 2008, or January of 2009. If you received an Economic Recovery Benefit in 2010, do not enter any Economic Recovery Benefits received...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 990 Schedule H 2024-2025